Approval of the financial statements for the 2024 fiscal year

21/03/2025

The partners of business companies, including corporations and/or limited liability companies, must hold an ordinary general meeting or partners’ meeting, respectively, to deliberate on the management accounts and the financial statements for the fiscal year ending December 31, 2024, as well as the distribution of its results.

When

Within the first four months of each fiscal year, that is, by April 30, 2025.

Requirements and Publications

Corporations must provide their shareholders with the following documents: (i) management report; (ii) financial statements; (iii) independent auditors’ report, if any; (iv) fiscal council opinion, if any; and (v) other documents related to the agenda, 30 days before the meeting is held.

Following recent legislative changes, privately held corporations must publish their financial statements in a widely circulated local newspaper, with the full publication on the newspaper’s website and a summarized version in the printed edition. Privately held corporations with gross revenue equal to or less than R$ 78 million may publish their financial statements exclusively electronically through the Public Digital Bookkeeping System (SPED), reducing their publication expenses.

Meanwhile, limited liability companies, including large companies (those with gross revenue above R$ 78 million), are no longer required to publish their financial statements for the annual partners’ meeting or to file the respective meeting minutes with the competent Commercial Registry, according to new understandings by the National Department of Business Registration and Integration (DREI) and the Superior Court of Justice (STJ), making such publications purely optional.

Effects

The law does not impose penalties on business companies that do not approve their accounts. On the other hand, failure to approve may result in certain limitations for the entrepreneur, such as disqualification from participating in public tenders; restrictions on entering into certain financial contracts, such as foreign exchange contracts; and the inability to file for judicial or extrajudicial reorganization, among others.

Our team is available to assist in holding the ordinary general meeting or partners’ meeting for the approval of the 2024 fiscal year accounts, as well as to clarify any additional questions on the subject.

Related

Ciari Moreira Advogados announces the arrival of Bertrand de Solere as a new partner at the firm. A Franco-Brazilian with over 25 years of experience, […]

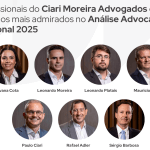

The 2025 edition of Análise Advocacia Regional highlighted several professionals from Ciari Moreira Advogados among the most admired in the Greater São Paulo region. Mentioned […]

We are proud to announce that our partner Leonardo Platais has been recognized by the Chambers and Partners – Regions 2025 ranking as a standout […]